Section 1: Industry Trends & Challenges in Footwear Distribution

The global footwear market is an expansive, multi-billion-dollar industry, encompassing a variety of segments such as sneakers, luxury shoes, athletic footwear, and sports shoes. The United States represents the largest footwear market globally, achieving over $85.8 billion in revenue collectively (Statista) from approximately 863 shoe brands and growing.

Historically, many consumers made do with just a pair or two of shoes—often focused on functionality. However, modern consumer behavior has shifted dramatically. Today, footwear collections are common, with different pairs used for formal occasions, casual outings, and athletic activities. This shift is reflected in the staggering numbers of shoes imported into the U.S.; in 2022 alone, about 2.7 billion pairs were imported, primarily from Asian countries. Footwear worth over $12 billion arrived from China alone in that year (Statista). In turn, all these shoes need to be distributed throughout the US.

Athletic footwear is a particularly fast-growing segment of the market. In 2022, the revenue for athletic footwear in the United States reached approximately $14.5 billion, with projections indicating that it will increase to over $17 billion by 2028 (Statista). Footwear, along with apparel, has increasingly become a way to express their identity or style, with consumers attaching value to brands that represent their identity. Leading brands and retailers play a critical role in this market by offering a wide range of styles and engaging in targeted advertising campaigns.

Nike, for example, has consistently held the largest share of the U.S. footwear market, generating a global turnover of approximately $51.2 billion in 2023, marking a 10% increase compared to the previous year. Specialization has created opportunities for newer brands to enter the market, and has increased the variety of SKUs that need to be managed. Consider the various kinds of shoes available for American Football alone – position specific cleats, turf varieties and more. With American interest broadening to grow sports such as Lacrosse, the challenge and opportunity for shoe distributors continue to expand. The challenge for mid-sized shoe companies and distributors including 3PLs is how to compete with that level of scale and their naturally derived efficiencies.

Consumer Behavior in the Footwear Market

Consumer spending on footwear continues to be substantial, with many people allocating significant portions of their discretionary income to apparel and footwear. Athletic clothing and footwear, in particular, have gained immense popularity in recent years, experiencing strong growth in the U.S. market. In 2022, wholesale sales of athletic footwear alone generated around $14.5 billion (Statista). Women in the U.S. tend to outspend men on footwear, with the average household expenditure on women’s footwear reaching just over $173 in 2022.

These trends highlight the increasing demand for a wide variety of footwear options and underscore the importance of effective supply chain and distribution strategies for footwear companies. The rise in consumer expectations—both in terms of style variety and availability—places significant pressure on distribution centers to be efficient, agile, and capable of scaling operations to meet market demands.

Rising Labor Costs and Scarcity of Labor

Labor is one of the most significant cost components in distribution, and footwear distribution centers are facing increasing difficulties in this area. According to recent data from the US Bureau of Labor Statistics, labor shortages in the Transportation, Warehousing, and Utilities sectors remain at historical highs despite slight improvements from pandemic peaks. While dropping from peak post-COVID levels,

job openings in warehousing remain near 25-year record levels, with the Federal Reserve’s FRED database indicating that the demand for warehouse employees has been on a steady rise for over 50 years (FRED).

https://fred.stlouisfed.org/series/JTU480099JOL

https://fred.stlouisfed.org/series/CES4300000003

Moreover, wages for workers in these sectors continue to climb, adding additional strain to operating budgets (FRED). The situation is further compounded by regional variations in labor costs and availability. In densely populated metropolitan areas or regions near major ports, competition for warehouse labor can lead to even higher wage premiums. Conversely, distribution centers located in smaller metropolitan or semi-rural areas face difficulties finding enough qualified workers, adding to the operational burden. This scarcity creates a cycle of inefficiency, with distribution centers continually scrambling to recruit, hire, and train new employees.

The Impact of Real Estate Costs

The cost of warehouse space has also become a significant issue for footwear distribution centers. In the U.S., the average asking rent for warehouse and distribution space reached a record high of $9.72 per square foot in 2023, representing a 20.6% increase over the previous year (CommercialEdge). New lease rates have similarly climbed, with an average cost of $10.36 per square foot over the past year. Costs vary widely based on geography—warehouses in Miami, for example, have lease rates significantly above the national average, while regions like the Bay Area lead in sales price per square foot, exceeding $500.

- Average Rent by Metro

Real estate costs present an especially challenging dynamic for medium-sized footwear distribution centers. Unlike large enterprises that can afford expansive, high-density facilities, medium-sized centers must make the most of their space while minimizing rental expenditures. This often results in operational

inefficiencies, as centers struggle to optimize their layout and storage capacity within limited space. The rising costs of industrial real estate, combined with the need for greater storage density, present a pressing financial challenge that requires innovative solutions.

Section 2: AMRs as a Savior to Fight Against Increasing Costs and Hiring Challenges

As footwear distribution centers grapple with rising costs associated with labor and real estate, the adoption of Autonomous Mobile Robots (AMRs) has emerged as a powerful solution. These technologies, which have evolved significantly in recent years, offer substantial cost-saving opportunities while maintaining operational flexibility—making them particularly well-suited to medium-sized distribution centers.

Understanding AMRs and Their Role in Modern Warehouses

Autonomous Mobile Robots are self-driving vehicles that can be deployed across a warehouse to assist with a range of tasks, such as transporting goods, managing inventory, and supporting order picking processes. Unlike traditional automation solutions that require fixed infrastructure—like conveyors and racking systems—AMRs are inherently flexible. They can be easily reprogrammed and re-routed to

accommodate changes in layout, inventory requirements, or workflow processes. This makes them particularly appealing to medium-sized footwear distribution centers that may not have the capital to invest in fixed automation but still require efficiency improvements.

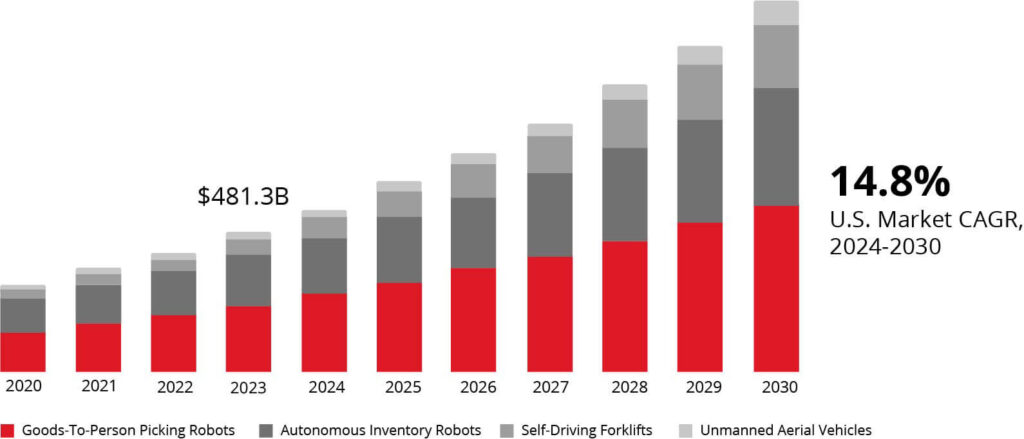

- U.S. Autonomous Mobaile Robots Market

Size,by Type, 2020-2030 (USD Million)

https://www.grandviewresearch.com/industry-analysis/autonomous-mobile-robots-market

Recent industry research highlights the impressive growth of AMR adoption. According to a report by Grandview Research, the market for AMRs is expected to grow significantly over the next decade, driven by the need for cost-effective, flexible automation solutions in industries like footwear distribution (Grandview Research). The ability of AMRs to adapt and integrate seamlessly with existing operations allows medium-sized distribution centers to implement advanced automation without the prohibitive costs and rigid infrastructure associated with fully automated systems.

Addressing Labor Scarcity with AMRs

Labor scarcity has been a persistent challenge in the distribution sector, with footwear distribution centers particularly affected by the fluctuating availability of warehouse workers. As mentioned earlier, the costs of hiring, training, and retaining employees are high, and labor shortages can lead to substantial productivity losses. The implementation of AMRs directly addresses these issues by reducing the dependence on manual labor for repetitive tasks, allowing the existing workforce to focus on more value-added activities.

AMRs significantly streamline warehouse operations by taking over many of the physically demanding and time-consuming tasks that were traditionally performed by human workers. By doing so, they free up personnel to concentrate on more complex or specialized activities—such as quality control and customer order management—that require human decision-making and problem-solving skills. This shift in task allocation not only boosts efficiency but also enhances job satisfaction and employee retention, as workers are less likely to burn out from repetitive manual tasks.

AMRs are also a major advantage in reducing the time needed to ramp up new hires. Since these robots handle a significant portion of the workload, new employees can be trained more quickly and can achieve productive outputs in a shorter time frame. The result is faster onboarding and reduced labor costs related to turnover and extended training periods.

Real Estate Optimization Through AMRs

In addition to addressing labor challenges, AMRs can also help reduce real estate costs—another significant financial burden for footwear distribution centers. By enhancing space utilization, AMRs allow facilities to maximize the use of available warehouse space without resorting to costly expansions or new leases. Unlike fixed automation systems, which can require large amounts of dedicated space, AMRs move freely throughout the facility, dynamically adapting to the available space.

This flexibility allows distribution centers to design their layout to maximize storage density while minimizing the footprint of automation infrastructure. For example, AMRs can operate in narrow aisles and adapt to dense racking configurations, allowing for more products to be stored in a given area. This is particularly valuable for distribution centers located in high-cost urban regions where space is at a premium.

Note that AMRs can be deployed in rack-supported multi-level pick modules as well as mezzanines. Care must be taken in designing or checking engineering load calculations, but this application allows for incredible storage density as well as great gains in labor efficiency. By utilizing multiple floors, distribution centers can increase storage density without increasing their physical footprint, thereby avoiding the high costs associated with leasing additional space. This makes AMRs an ideal solution for distribution centers aiming to optimize storage without incurring prohibitive real estate expenses.

Lower Capital Investment Compared to Traditional Automation

Another key benefit of AMRs is their lower capital investment compared to traditional automation systems like conveyor systems. While conveyor systems can streamline specific processes, they are often fixed, require significant upfront costs, and can be challenging to modify as operational needs change. AMRs, on the other hand, offer flexibility, require a significantly lower initial investment, and can be deployed quickly with minimal disruption to ongoing operations.

For medium-sized footwear distribution centers, the scalability of AMRs is also a major advantage. They can be deployed incrementally, allowing facilities to gradually increase their level of automation as demand grows. This is in stark contrast to fixed automation systems, which typically require an all-or-nothing approach to implementation. With AMRs, distribution centers can start with a small number of robots to address the most pressing operational challenges and then expand as the business grows, minimizing financial risk while ensuring continuous improvement in efficiency.

Section 3: Comparative Cost Analysis

To illustrate the financial impact of adopting AMRs, it is essential to conduct a comparative cost analysis between traditional manual operations, full-scale fixed automation, and AMRs. For medium-sized footwear distribution centers with between 100 and 1,000 employees, this comparison can shed light on the cost-saving potential of AMRs, particularly in the context of labor and real estate expenses.

Labor Cost Analysis

Labor costs represent one of the most significant expenses for any distribution center. With average wages for warehouse workers steadily rising, combined with ongoing labor shortages, distribution centers must find ways to minimize their reliance on manual labor without sacrificing efficiency. The adoption of AMRs directly addresses these issues by automating many of the repetitive, labor-intensive tasks traditionally performed by human workers.

A detailed cost analysis of a typical distribution center reveals that implementing AMRs can reduce the overall need for manual labor by 30-60%, depending on the specific operations and volume of goods handled. Consider this case study of a warehouse that added Rapyuta Robotics for a 60% reduction in picking labor thanks to significant increase in pick rates. This reduction in labor requirements can translate into significant savings on wages, benefits, and training costs. Additionally, by decreasing the time needed for new hires to become productive, AMRs help reduce the hidden costs associated with turnover and prolonged training periods.

Why Turnover Can Kill Your Business

Here are some costs to include in a burdened labor cost, which is the total cost of employing a worker beyond their base salary:

- Training: Costs related to employee development, such as training courses, workshops, and seminars.

- Turnover: The cost of replacing an employee, which can be as high as 33% of their annual salary.

- Payroll taxes: Taxes that an employer pays on behalf of their employees, such as Social Security and Medicare taxes.

- Benefits: Costs such as health insurance, retirement plans, and life insurance.

- Equipment and supplies: Tools, uniforms, laptops, and other supplies needed for an employee to perform their job.

- Paid time off: Vacation, sick leave, and other paid time off.

- Travel expenses: Costs associated with travel.

- Workers’ compensation: Workers’compensation insurance.

- Liability insurance: Liability and automotive insurance.

- Administrative overhead: Time spent in meetings, commuting, and other administrative costs.

Did you notice the cost of turnover being listed as high as 33%? This element is frequently overlooked or undervalued. Breaking out the elements that may go into turnover cost can help make the realization more clear.

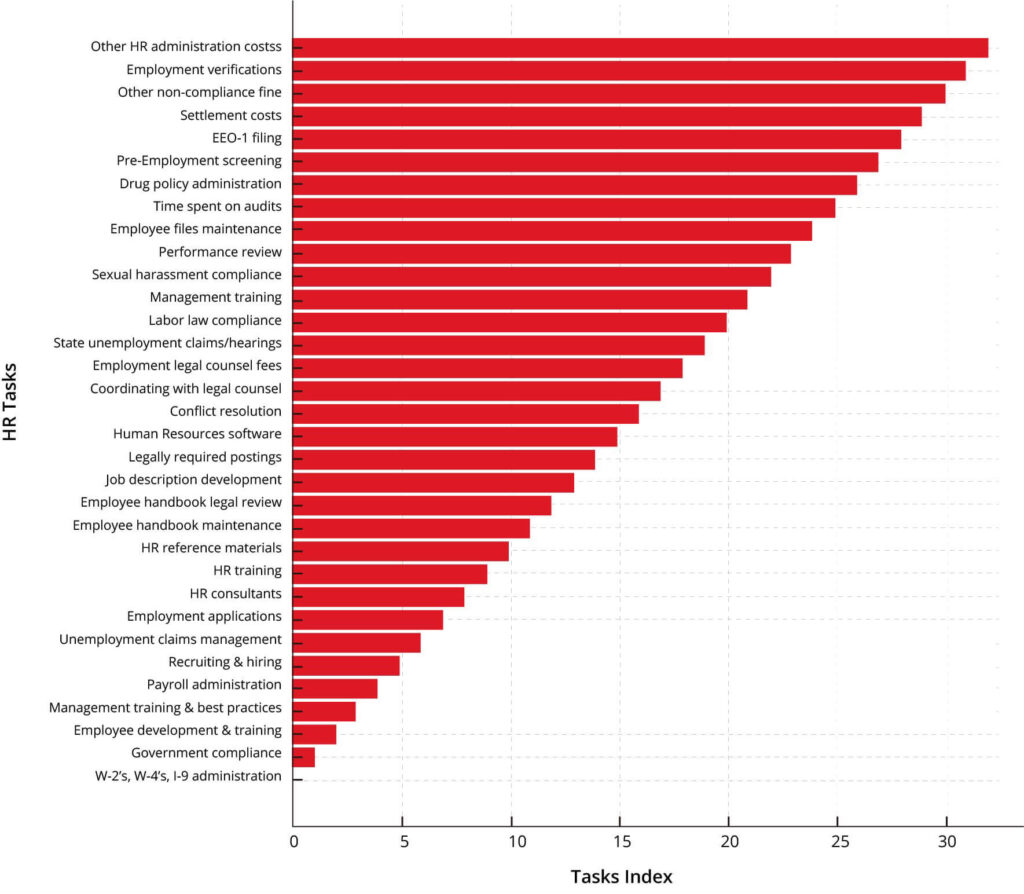

Understanding the True Cost of Employee Turnover

Besides each employee’s time allocated to hiring, training, and onboarding, consider the additional time of professionals such as HR, legal, management, and IT. Each of these functions supports the hiring and retention process, but when turnover rates are high, these efforts multiply.

- The High Cost of Turnover

While these activities are essential for any business, frequent turnover significantly amplifies costs. A helpful tool to better analyze these expenses is a labor burden cost calculator, which accounts for:- Hours worked and wages

- Government compliance costs

- Benefits and additional labor-related expenses

On average, the fully burdened labor rate—the real cost of employing someone—is 40–50% higher than their base wage. For example, an employee earning $25/hour may actually cost $35–$38/hour when all associated costs are considered.

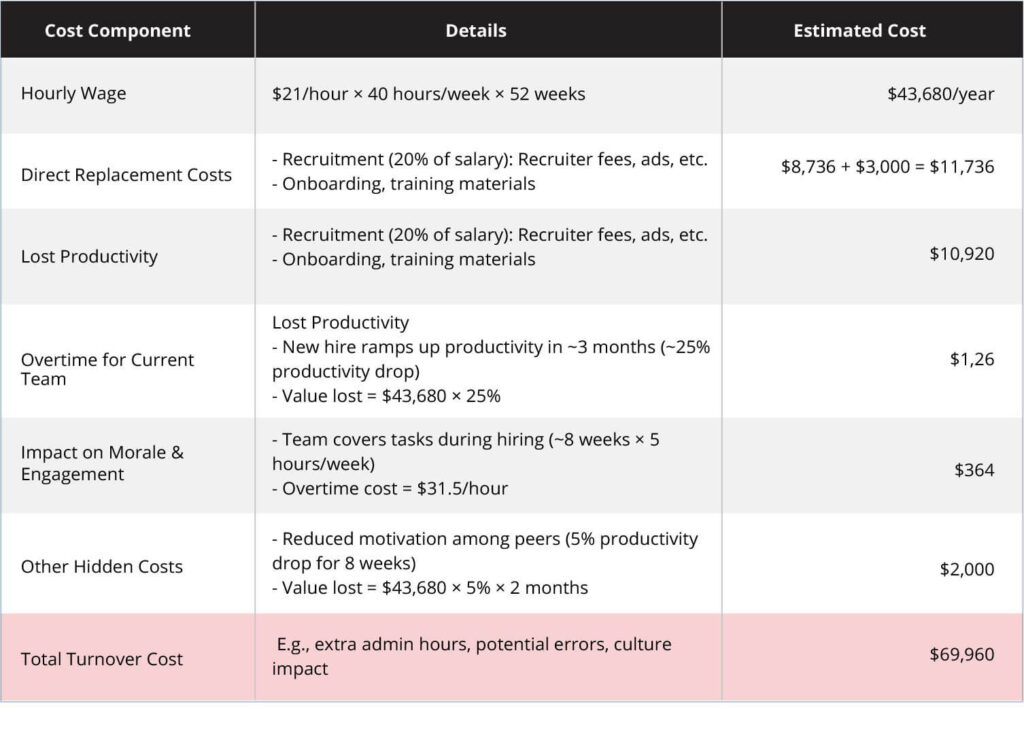

- Turnover Cost Breakdown Example

Here’s a model case to demonstrate the total cost of turnover for a worker hired at a direct cost of $21/hour:

By carefully evaluating these costs, organizations can understand the significant impact of turnover and take steps to build a work environment that promotes retention, productivity, and morale. Investing in employee satisfaction is not just about creating a better workplace—it’s a financially sound decision that directly impacts your bottom line.

Real Estate Cost Analysis

Real estate costs can vary significantly depending on the location of a distribution center, with some regions seeing rates as high as $10-15 per square foot. The implementation of AMRs can help alleviate these costs by improving the efficiency of space utilization. For example, by allowing for narrower aisles and higher-density racking, AMRs enable distribution centers to store more goods in the same footprint, reducing the need for additional warehouse space.

Consider a medium-sized distribution center operating in a high-cost urban area with a lease rate of $12 per square foot. By implementing AMRs and optimizing space utilization, the facility could potentially reduce its storage requirements by 20-30%. This reduction could translate into annual savings of tens of thousands of dollars in rent alone, making AMRs a financially attractive solution for medium-sized

operations facing high real estate costs.

ROI and Payback Period

When evaluating the return on investment (ROI) of AMRs, it is important to consider both the initial capital investment and the ongoing cost savings in labor and real estate. Compared to traditional fixed automation solutions, which often require significant upfront capital expenditures and years to achieve a return, AMRs offer a much shorter payback period.

For a medium-sized footwear distribution center, the payback period for an AMR implementation can be as short as 12-18 months, depending on the scale of deployment and the specific cost savings achieved. This quick return, combined with the flexibility to scale the solution as needed, makes AMRs an ideal choice for medium-sized centers that need to compete with larger, more automated competitors without overextending financially.

Section 4: Real Estate Savings with Rapyuta PA-AMRs

For medium-sized footwear distribution centers, real estate is a significant cost factor that cannot be overlooked. As lease rates continue to rise, it becomes increasingly important for distribution centers to make the most efficient use of their existing space. Rapyuta Robotics’ Pick-Assist Autonomous Mobile Robots (PA-AMRs) provide a unique solution that allows businesses to optimize their real estate usage without the need for extensive and costly infrastructure changes.

Maximizing Space Utilization with PA-AMRs

The implementation of PA-AMRs can greatly enhance space utilization in distribution centers. Unlike traditional fixed automation systems, PA-AMRs are flexible and adaptable, capable of navigating complex warehouse environments while optimizing the use of available space. By enabling the movement of goods in narrower aisles and utilizing higher-density racking, PA-AMRs help maximize the capacity of a given footprint.

This enhanced efficiency in space utilization means that distribution centers can store more products in the same space, which can significantly reduce real estate costs. By adopting PA-AMRs, facilities can avoid the need to lease additional space or expand their physical footprint, which is particularly valuable in regions where real estate prices are high.

For example, the flexibility of PA-AMRs allows them to operate efficiently in warehouses with unconventional layouts or older buildings, where traditional automation systems may be challenging to implement. PA-AMRs can adapt to the existing environment, reducing the need for costly renovations or expansions to accommodate automation.

Specifically, consider that Rapyuta Pick-Assist AMR solution is designed to integrate seamlessly into existing warehouse environments without necessitating layout changes. This solution can double picking productivity while maintaining safety and efficiency.

Real Estate Costs in High-Cost Regions

In regions where the cost of leasing warehouse space is especially high, the value proposition of AMRs becomes even more compelling. For example, in areas like the Bay Area or New Jersey, where industrial lease rates can exceed $10 per square foot, the ability to reduce space requirements by 20-30% through AMR implementation can yield significant financial benefits. As illustrated in Section 4, these savings can amount to hundreds of thousands of dollars annually, depending on the size of the facility and the lease rate.

The ability of AMRs to enhance vertical storage and facilitate multi-level operations also provides an effective way to maximize the use of expensive real estate. For example, AMRs can efficiently operate on mezzanines and multi-level pick units, which helps improve the overall storage density of the facility. By increasing storage capacity without expanding the footprint, AMRs enable distribution centers to reduce their reliance on additional leased space, leading to substantial real estate savings.

Shoe distribution centers can consider the Rapyuta PA-AMR XL model, for example, which supports up to two 75L totes and is suitable for handling larger items such as shoe boxes. Its adaptability makes it ideal for various products, including footwear, thereby streamlining operations and reducing labor-intensive processes.

Case Study: Real Estate Optimization with AMRs

Consider a footwear distribution center in the Northeastern United States that is facing rising real estate costs due to high demand for industrial space. By implementing Rapyuta PA-AMRs, the facility was able to optimize its storage layout, reducing the need for leased space by 25%. This translated to an annual real estate savings of $240,000, allowing the distribution center to reallocate those funds to other areas of the business, such as technology investments and workforce training.

In this way, AMRs provide a tangible solution for medium-sized distribution centers seeking to control their real estate expenses and remain competitive in an increasingly challenging market environment.

Section 5: Addressing Labor Challenges with AMRs

Labor challenges, including scarcity, rising wages, and high turnover, are among the most pressing issues faced by footwear distribution centers today. Rapyuta PA-AMRs offer a practical solution to these labor challenges by automating routine tasks, improving worker efficiency, and reducing the overall dependence on manual labor.

Reducing Dependency on Manual Labor

The footwear distribution industry has traditionally been labor-intensive, relying on workers for tasks such as order picking, inventory management, and material transport. However, as labor shortages persist and wages rise, this model has become increasingly unsustainable. AMRs help alleviate these challenges by automating the transport of goods within the warehouse, allowing workers to focus on more complex tasks that require human judgment and expertise.

By reducing the number of manual tasks, AMRs enable distribution centers to operate with a smaller workforce while maintaining or even improving productivity levels. This reduction in dependency on manual labor is particularly valuable in regions where labor shortages are severe or where competition for qualified workers drives up wages. For medium-sized distribution centers, this means lower labor costs and a more predictable cost structure, which is crucial for long-term financial planning.

Accelerating Training and Onboarding

Another significant advantage of AMRs is their ability to accelerate the training and onboarding process for new employees. In a traditional warehouse environment, new hires often need extensive training to learn how to navigate complex layouts, operate material handling equipment, and perform their tasks efficiently. This training period can be both time-consuming and costly, especially in environments with high turnover rates.

With AMRs, the complexity of the onboarding process is significantly reduced. Since the robots handle much of the internal transport and routine material handling, new employees can be onboarded more quickly and with less intensive training. Instead of spending weeks learning how to manually navigate the warehouse, new hires can focus on higher-value tasks from day one, leading to faster productivity and lower training costs.

Enhancing Worker Safety and Satisfaction

AMRs also contribute to a safer and more satisfying work environment, which can have a positive impact on employee retention. By taking over physically demanding and repetitive tasks—such as moving heavy loads or walking long distances—AMRs reduce the risk of workplace injuries and help create a safer work environment. This is particularly important in the footwear distribution industry, where employees often handle large volumes of products that can be cumbersome to transport manually.

Moreover, by reducing the physical demands placed on workers, AMRs can lead to higher job satisfaction and lower turnover rates. Employees who are not burdened with repetitive and exhausting tasks are more likely to stay with the company, reducing the costs associated with high turnover. In an industry where employee retention is a significant challenge, improving job satisfaction through automation can yield substantial cost savings and help maintain operational stability.

Flexibility in Workforce Allocation

One of the most compelling benefits of AMRs is the flexibility they provide in workforce allocation. During peak periods, such as holiday seasons or promotional events, distribution centers often face a surge in demand that requires additional labor. Hiring temporary workers during these periods can be costly and challenging, especially given the current labor shortages.

AMRs provide a flexible alternative. By increasing the number of robots deployed during peak periods, distribution centers can scale their operations to meet demand without the need for temporary labor. This flexibility allows facilities to maintain optimal productivity levels during peak periods while avoiding the high costs associated with hiring and training temporary staff. As a result, AMRs not only reduce overall labor costs but also provide a more efficient way to manage seasonal demand fluctuations.

- Maximizing Picking Efficiency with Robot Clustering

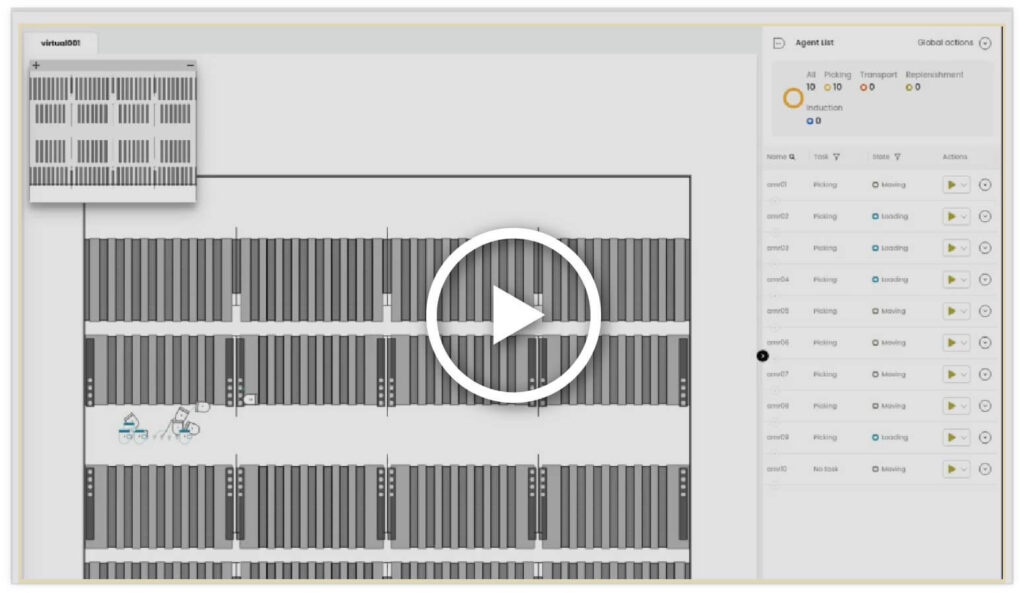

Note: A simulation video demonstrates this functionality on a large virtual map of PA-AMRs, showcasing how robots cluster and collaborate effectively in larger environments.

Robot clustering ensures that robots operate in close proximity, grouping together in large warehouses. This allows pickers to always have a robot nearby, reducing walking distances and optimizing the picking process.

In contrast, without this function, robots would distribute themselves throughout the warehouse, focusing solely on individual orders and missing the opportunity to work collaboratively

Section 6: Rapyuta PA-AMRs as the Competitive Advantage

Medium-sized footwear distribution centers face unique challenges in competing with large-scale, highly automated operations. Giants in the industry have access to capital that allows for substantial investments in automation, resulting in faster and more efficient operations. However, the introduction of Autonomous Mobile Robots (AMRs) from Rapyuta Robotics offers medium-sized distribution centers the opportunity to level the playing field, enabling them to achieve the efficiencies of large-scale operations without the associated costs.

Competing Against Mega Automated Facilities

Large players in the footwear industry, such as those with fully automated facilities, set high standards for efficiency and throughput. For medium-sized facilities with limited capital and resources, competing against these giants might seem daunting.

Rapyuta PA-AMRs can deliver comparable efficiency gains at a fraction of the cost. With their scalable deployment model, AMRs can be gradually integrated into existing operations, allowing for a smooth transition to automated processes. This flexibility is crucial for medium-sized distribution centers that must balance automation with maintaining current operations and managing capital costs.

The ability of Rapyuta PA-AMRs to operate efficiently in smaller and dynamic environments gives medium-sized distribution centers an edge. AMRs are designed to fit into existing workflows, maximizing productivity without disrupting ongoing operations. By reducing dependency on manual labor and optimizing storage, medium-sized facilities can effectively compete with their larger counterparts while maintaining a lower cost structure. For more information on how Rapyuta PA-AMRs can improve productivity, please visit Rapyuta Robotics Warehouse Automation.

Scalable Solutions for Dynamic Needs

One of the primary advantages of Rapyuta PA-AMRs is their scalability. Unlike traditional fixed automation, which requires substantial upfront investment and often an all-or-nothing approach, AMRs can be scaled up or down based on specific business needs. During peak periods, such as the holiday season or major promotional events, additional robots can be deployed to manage increased demand. Conversely, during off-peak times, fewer robots can be used to maintain cost-efficiency.

This scalability also applies to expanding warehouse operations. As a distribution center grows, it can add more AMRs to its fleet rather than investing in costly and space-consuming fixed infrastructure. This approach allows for greater flexibility in capital expenditure and ensures that automation capabilities align closely with business growth. Rapyuta Robotics’ solutions are designed to evolve with the needs of their clients, making them an ideal partner for medium-sized distribution centers looking to expand and compete more effectively. For details about Rapyuta’s scalable solutions, see Rapyuta Robotics Solutions.

Optimizing Costs to Stay Competitive

Medium-sized footwear distribution centers face significant financial pressures from rising labor and real estate costs. Rapyuta PA-AMRs address these challenges head-on by reducing labor dependency, optimizing space utilization, and increasing overall operational efficiency—all of which contribute to lowering operational costs.

When compared to traditional labor and fixed automation, AMRs offer a faster return on investment. Medium-sized centers that adopt AMRs can expect to see a reduction in overall labor costs, including wages, training, and turnover-related expenses, as well as significant savings in real estate expenses due to more efficient use of available space. Furthermore, AMRs improve order accuracy and reduce cycle times, contributing to better customer service and increased revenue opportunities.

For medium-sized footwear distribution centers, these efficiencies translate to a more competitive position in the marketplace. With lower operational costs and the ability to meet customer demands with speed and accuracy, medium-sized facilities can effectively compete with the most efficient distribution centers, including those with extensive fixed automation infrastructure. For more information on how Rapyuta Robotics helps to optimize operational costs, please visit Rapyuta Robotics Technology.

Conclusion

The footwear distribution industry is evolving rapidly, driven by increasing consum-er demands, rising labor costs, and escalating real estate expenses. For medi-um-sized footwear distribution centers—those with 100 to 1,000 employ-ees—keeping up with these changes while maintaining profitability can be chal-lenging, particularly when competing against larger, highly automated facilities.

Rapyuta Pick-Assist Autonomous Mobile Robots (PA-AMRs) offer a practical, cost-ef-fective solution to address these challenges. By reducing labor dependency, opti-mizing space utilization, and improving operational efficiency, AMRs provide signifi-cant financial benefits, including lower labor costs, reduced real estate expenses, and improved productivity. Unlike traditional fixed automation systems, which require substantial upfront investment and extensive infrastructure, AMRs offer a flexible, scalable alternative that allows medium-sized distribution centers to reap the benefits of automation without the prohibitive costs.

In addition to cost savings, Rapyuta PA-AMRs provide a competitive edge by en-hancing the efficiency and scalability of operations. Whether it’s through faster onboarding, improved space utilization, or the ability to scale operations dynami-cally, AMRs empower medium-sized footwear distribution centers to compete effectively in the marketplace. By adopting AMRs, these facilities can achieve a higher rate of return on investment and create a more agile, resilient supply chain.

For medium-sized footwear distribution centers, the decision to implement AMRs is more than just a step toward automation; it’s a strategic move to remain competi-tive in an industry that continues to evolve. With Rapyuta Robotics’ solutions, medium-sized centers can position themselves as strong contenders in the mar-ket—capable of delivering the speed, efficiency, and accuracy demanded by today’s consumers. To learn more about how Rapyuta Robotics can help your distribution center stay competitive, please book a call for Expert Consultation.